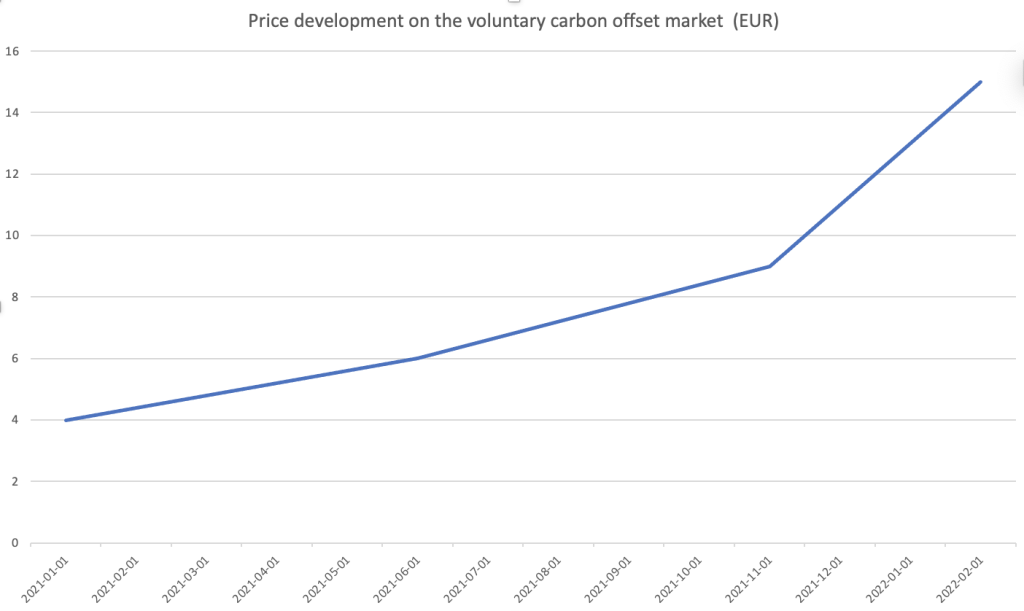

The last 6 months have been busy in the voluntary carbon offset market. Demand have surged and prices have increased 3-5 fold. This happened mostly on what is called off the shelf credits – credits that are available for purchase now – but also on credits that can be contracted for future issuance.

The Background

When a certified climate project does climate impact and it can be verified, they receive one climate credit for every tonne CO2e saved from entering the atmosphere.

Certified carbon credits are then sold on a market – the voluntary carbon offset market. It being a market means that the price is determined by the buyers and sellers agreeing on a price that is beneficial for both parties.

The effect of this is that prices can vary over time, so when sellers see an increase in demand they can increase the price and vice versa.

A market has many advantages, it’s easy to scale, it’s efficient and it minimizes waste. But, it also has some disadvantages, the primary one many are feeling now is that it’s hard to predict where the prices are going in order to plan future purchases.

How much of an increase are we seeing now?

As of January 2022, we at GoClimate saw an increase of prices with 3-5 times for the type of high quality Gold Standard-certified projects we support. This has resulted in that we increased our prices to our GoClimate members from 4 EUR per tonne to 15 EUR per tonne. This is quite a dramatic increase which have lead to members scaling down the amount they offset, and business customers needing to redo their budgets.

Bear in mind that we at GoClimate are buying big volumes (50-100k) and spending lots of time sourcing the best and most efficient high quality carbon credits. Prices for smaller volumes are typically higher.

What are the consequences?

Just to be clear, this price increase is brilliant news for the climate. It will mean that:

- Companies and individuals are even more incentivized to lower their emissions.

- Climate projects get more money for doing climate impact. This leads to even more climate projects being built – and more climate impact!

This price increase happening now is exactly what we at GoClimate has strived for since the start. Finally it starts to get even more profitable to save the climate!

Why are we seeing an increase now?

It’s not possible to know the exact reasons, but clear is that demand for climate credits have increased by a lot. Our hypothisis on why this has happened is:

- After COP26 the interest among individuals and companies to do something about climate change increased, and offsetting – even though not the only tool – is something you can do now and that has a fairly high impact (if done in high quality climate projects) for a relatively low effort.

- Cryptocurrency has entered the market. KlimaDAO has purchased about 14,7 million credits in just the last few months. And that are even more crypto projects out there.

- Net Zero-targets have been set by many companies. SBTi definition of Net Zero mentions offsets a tool to help with climate financing even though it’s not enough to claim Net Zero (which is also GoClimates view).

- The general awareness of climate crisis has increased. It’s more clear to businesses and individuals that we all need to act now and that time is running out.

Feel free to add other thoughts in the comments below.

The Future

It’s impossible to predict the future of a market, but I personally don’t see anything which suggests a decrease in demand the coming 5-10 years, rather the opposite. That could be interpeted as a reasons that the price would not go down, but as in all chaotic systems this view might already be priced into the market.

On the supply side of the market, I believe it will take a couple of years for climate projects to initiated and credits being approved and issued. This means that the market will not see lots of new climate projects any time soon.

Depending on what type of offsets you are looking at there are speculation that the prices will continue to rise, maybe as much as 50x more. I feel quite confident that this is not the case of Gold Standard credits though, but an 2x increase during 2022 is of course not possible to rule out.